Feeling overwhelmed by business debt while managing payroll, vendor payments, and growth? You’re not alone. Without a clear, actionable repayment strategy, it’s easy to lose control of your cash flow and put your company’s financial health at risk.

That’s why having a solid plan isn’t just practical—it’s fundamental to safeguarding your business’s future.

Two proven strategies—the debt avalanche and debt snowball methods—can help you take charge, reduce stress, and set your business on the path to long-term success. Choosing the right approach empowers you to regain control and build a stronger financial foundation.

What is the Debt Avalanche Method?

For small business owners facing multiple debts—such as merchant cash advances, business credit cards, or equipment loans—the debt avalanche method is a disciplined, and cost-saving approach. Here’s how it works: list all your business debts and prioritize them by the highest interest or factoring rate (for MCAs). You’ll continue making minimum payments on every account, but extra funds can go toward the debt with the highest rate.

This method is ideal if your focus is on minimizing total costs. By tackling your most expensive debt first, you reduce the overall interest or fees draining your cash flow. However, this approach requires patience, as it may take longer to see a debt fully paid off—especially if your highest-rate balance is also your largest MCA or credit line.

What is the Debt Snowball Method?

The debt snowball method is designed for business owners who need quick wins to stay motivated. Instead of focusing on interest rates, you list your debts from smallest to largest balance. Make minimum payments on all, but direct any extra cash toward the smallest debt. Once that’s cleared, roll the payment into the next smallest, and so on.

This approach is particularly effective for small business owners managing several smaller vendor accounts or credit lines. Paying off these balances quickly gives you a psychological boost and simplifies your bookkeeping. The trade-off? You may pay more in total interest or fees, especially if your smallest debts aren’t your most expensive.

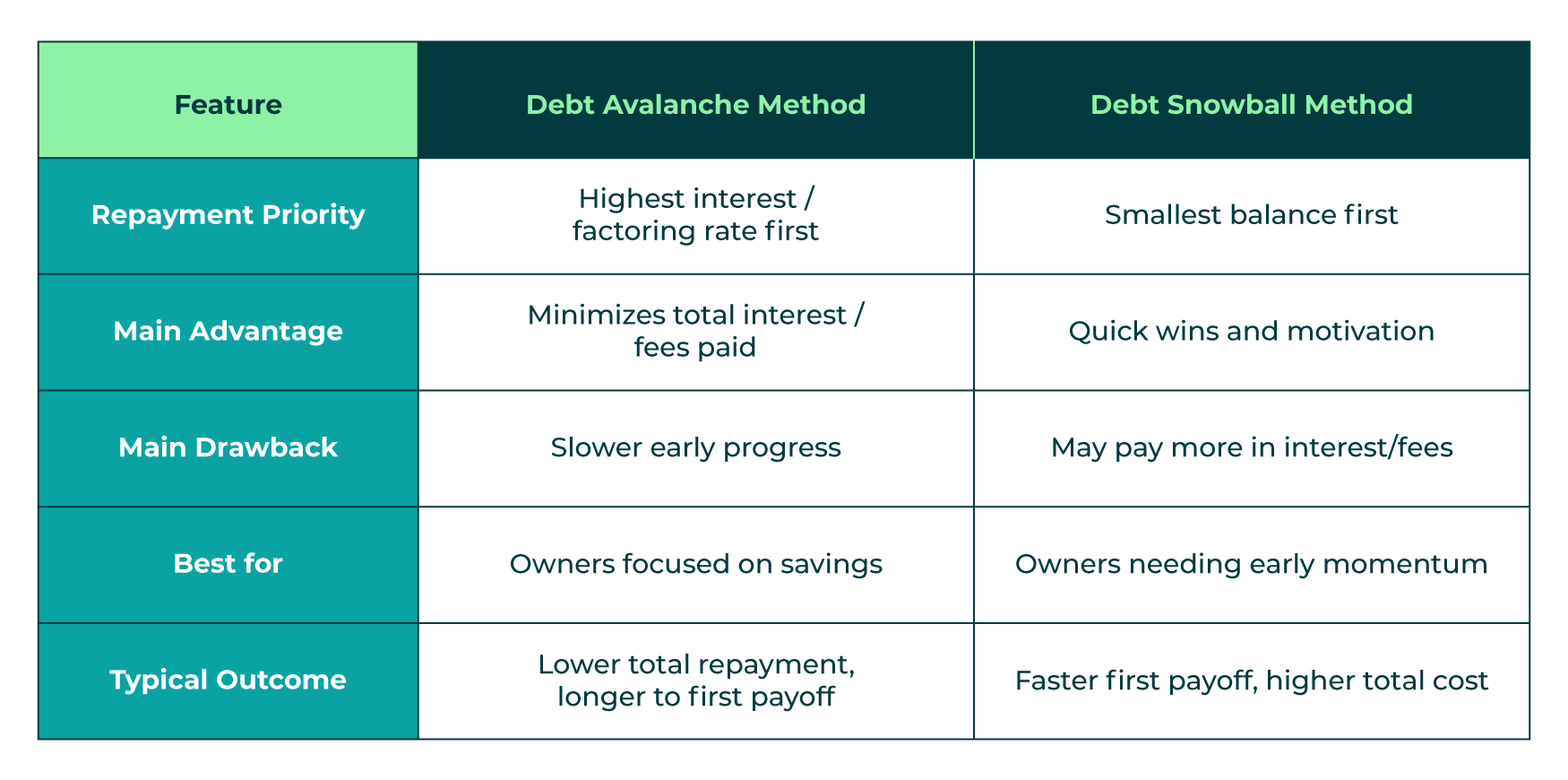

Debt Avalanche vs. Debt Snowball: What’s the Difference for Business Owners?

Both strategies require you to make minimum payments on all business debts, but the key difference is what you target first: cost or size. The avalanche method is best for owners who want to minimize expenses and are comfortable waiting for the first “win.” The snowball method suits those who need immediate progress to stay engaged—think of the relief of closing out a vendor account or eliminating a small MCA.

Business owners with high-cost MCAs or credit cards often benefit most from the avalanche method, while those with many small supplier balances may find the snowball method more motivating. Ultimately, your business’s cash flow, debt structure, and your own leadership style will determine which is the better fit.

Debt Avalanche vs. Debt Snowball Comparison Chart

How to Choose the Right Debt Repayment Strategy

Start by reviewing your business’s debt list: What’s costing you the most each month? Are MCAs or high-rate credit cards draining your working capital, or do you have several small balances cluttering your books? Consider your motivation—do you need to see accounts closed quickly to stay on track, or are you disciplined enough to focus on long-term savings?

Use accounting software or a simple spreadsheet to track your progress, and set regular check-ins to review your results. Remember, the best strategy is the one you’ll stick with—so choose the approach that fits your business’s needs and your leadership style. And before diving into repayment, it’s important to understand your business credit profile. Check your credit report and learn why it matters for managing debt.

Estimate Your Savings With Our Debt Calculator

Want to see how much you could save? We’ve made it easy to estimate your potential savings based on your actual debt and payment details. Try our Debt Savings Calculator! This powerful tool helps you visualize your options and make informed decisions tailored to your business’s unique situation.

Repayment Strategy FAQs

Q: Which method saves more money for my business?

A: The avalanche method usually results in lower total costs, especially if you have high-rate MCAs or credit cards.

Q: Can I switch between methods if my business needs change?

A: Absolutely. Many business owners start with the snowball for early wins, then switch to the avalanche as their confidence grows.

Q: How do I keep myself (and my team) motivated during debt repayment?

A: Set milestones, celebrate small victories, and track your progress using digital tools or spreadsheets. Tie these milestones to your broader business goals to maintain focus and motivation.

Q: Are there tools or calculators to help business owners choose?

A: Yes. Many accounting platforms and online calculators can help you model repayment scenarios and track your progress.

Q: Should I pay off business or personal debt first?

A: Focus on the debts that pose the greatest risk to your business’s cash flow and operations. For most owners, high-cost business debts should come first.

Making the Right Choice: Your Path to Debt Freedom Starts Here

Both the debt avalanche and debt snowball methods can help your business eliminate debt and regain financial flexibility. The key is to choose the strategy that fits your business’s unique needs and your leadership style—and then commit to it. With the right plan and consistent action, you’ll protect your business’s cash flow, improve your credit profile, and build a stronger foundation for future growth.