Most business owners keep a close eye on their personal credit score but often overlook their business credit. Yet, business credit is equally important. It’s directly tied to your company’s reputation and financial credibility, influencing everything from securing capital to negotiating with suppliers.

Your business credit score is more than just a number—it’s a tool that can be leveraged to access favorable financing, lower rates, and better terms with partners and vendors. By understanding and actively managing your business credit, you position your company to seize new opportunities, weather economic challenges, and drive sustainable growth.

“In today’s volatile market, business owners who take charge of their debt are better positioned to weather uncertainty and seize new opportunities.” – Lee Steinberg, Debt Consultants Group

Let’s break down what’s inside your business credit score, how to check it for free, and why this rating matters for every business owner.

What’s Inside Your Business Credit Score?

Business credit scores, typically ranging from 1 to 100, reflect your company’s creditworthiness in the eyes of lenders and partners. Several factors go into these scores, including:

● Payment history with lenders and suppliers

● Outstanding account balances and credit utilization

● Age and size of your business

● Industry risk

● Public records (liens, judgments, bankruptcies)

● Number of trade experiences and credit inquiries

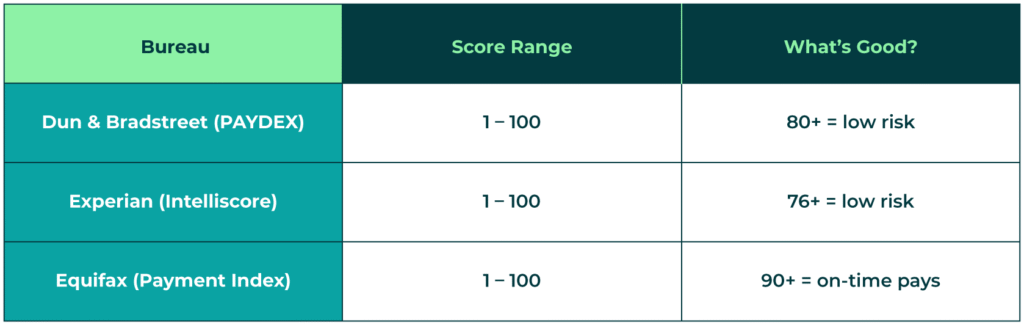

The three major business credit bureaus—Dun & Bradstreet (D&B), Experian, and Equifax—each use their own scoring models and databases. It’s important to monitor your profile with all three, as lenders and suppliers may check any or all of them.

Why Business Credit Matters for Every Owner

Your business credit score reflects your company’s financial trustworthiness. Here’s why it matters:

● Access to Financing: Lenders use your score to decide if you qualify for loans, lines of credit, and what rates or terms you’ll receive.

● Better Vendor Terms: Suppliers may check your score before offering net terms or discounts, impacting your cash flow and purchasing power.

● Lower Insurance Premiums: Insurers often use business credit to set rates, so a higher score can mean lower costs.

● Increased Credibility: A strong score builds trust with partners, clients, and even potential investors, supporting your business’s long-term growth.

How to Check Your Business Credit for Free

You don’t have to pay to know where your business stands. Here’s how you can check your business credit for free:

● Nav: Offers free summaries of your D&B, Experian, and Equifax business credit reports. You can see key details and get alerts; full reports require a paid upgrade.

● CreditSignal by D&B: Provides free alerts when your D&B report changes. While you won’t see the full report for free, you’ll know if something important happens.

● Experian: Lets you search for your business and view some basic information for free; more detailed reports are available for a fee.

How to get started:

- Sign up for a free account with Nav, CreditSignal, or Experian.

- Verify your business details (EIN, business address, etc.).

- Review your summary report for accuracy and recent changes.

- If needed, consider a paid report for in-depth details.

- Check for inaccuracies and dispute any errors–this can typically be done online or by contacting the bureau directly.

Note: Free reports provide a snapshot, but paid versions offer more data, including payment histories and risk factors.

What’s Considered a Good Business Credit Score?

Each bureau uses its own scale, but here’s a general guide:

Lenders and suppliers typically look for scores in the “low risk” category, but requirements may vary by industry and lender.

How to Establish Business Credit if You’re Just Starting Out

Building business credit is a process, but it starts with a few simple steps:

● Register for a DUNS number with Dun & Bradstreet

● Open a dedicated business bank account

● Work with vendors and suppliers who report payment history to credit bureaus

● Keep your business and personal finances separate

● Pay all bills on time and monitor your credit profile regularly

Taking these actions early helps you build a positive credit history and sets your business up for future success.

Business Credit Score FAQs

Q: Will viewing my score impact the scores?

A: No, checking your own business credit is considered a “soft inquiry” and does not affect your score.

Q: Who are D&B and Nav?

A: Dun & Bradstreet (D&B) is a major business credit bureau, while Nav is a platform that aggregates credit data from multiple bureaus and provides free business credit summaries.

Q: Does my business credit scores alone determine if I get credit?

A: Not always. Lenders also consider your revenue, time in business, industry, and other financial factors.

Q: How can I access my free business credit scores?

A: Use platforms like Nav or CreditSignal for free summaries and alerts, or check Experian for basic details.

Q: What do business credit scores measure?

A: They measure your company’s creditworthiness based on payment history, debt levels, public records, and more.

Q: How to improve business credit scores?

A: Pay bills on time, reduce debt, monitor your reports for errors, and work with vendors who report to bureaus.

Quick Tips for Building and Protecting Your Business Credit

Protecting your business credit doesn’t have to be complicated. By following a few smart habits, you can build a strong credit profile and avoid costly setbacks.

Smart habits to adopt include:

● Pay bills early or on time

● Monitor your credit reports regularly

● Dispute errors promptly

● Limit credit inquiries

● Keep debt levels manageable

Stay Proactive with Your Business Credit

Staying on top of your business credit is one of the smartest moves you can make as an owner. By checking your scores regularly and taking steps to build a strong credit profile, you’ll unlock better financing, stronger vendor relationships, and more opportunities for growth. Let’s keep our businesses ready for whatever comes next—starting with a healthy credit score.